Shakepay empowering customers with expanded suite of financial tools

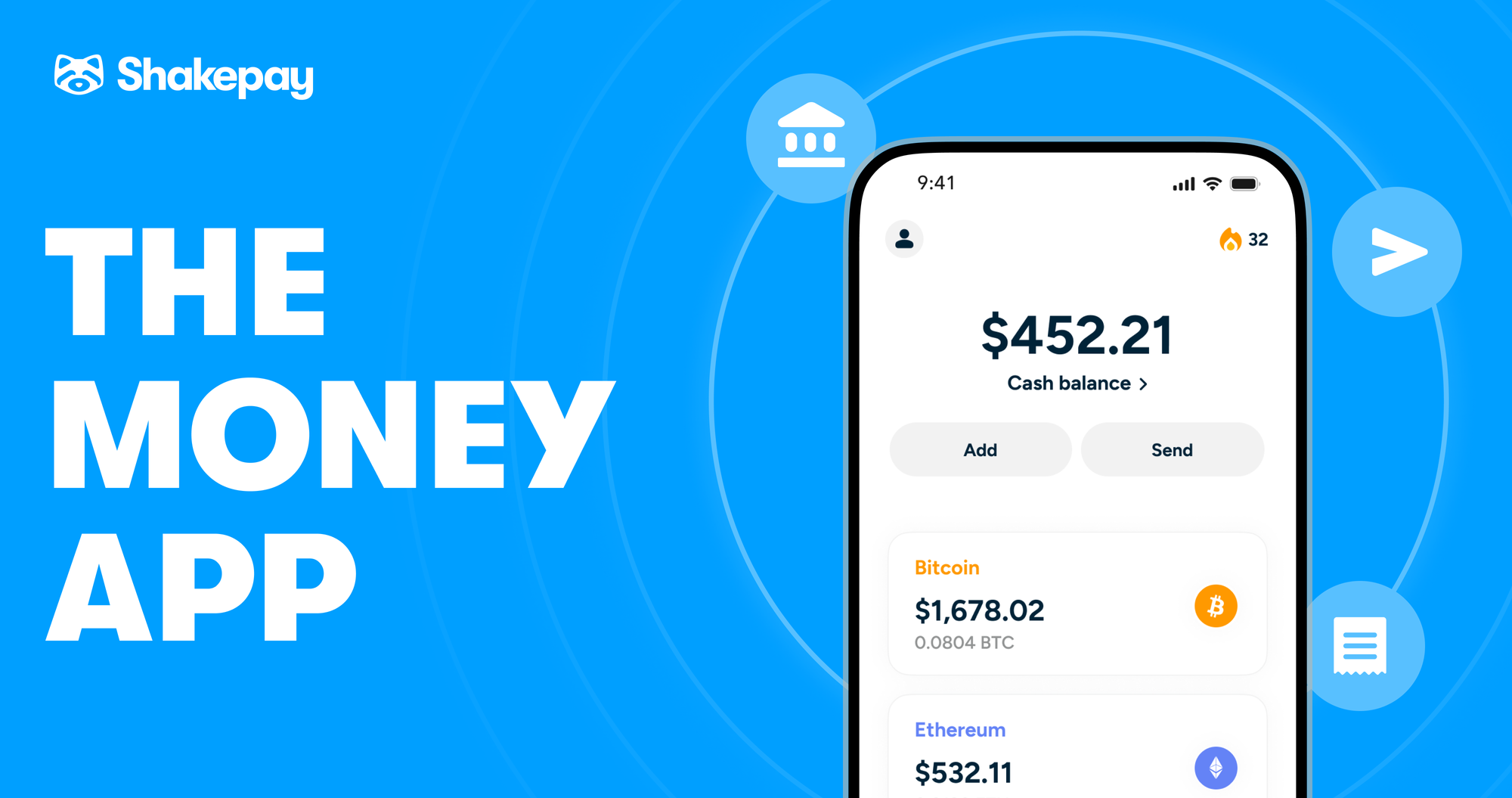

Montreal (November 28, 2023): Shakepay today launches everyday payments for all customers – direct deposit, pay bills, e-Transfer to friends and rewards for regular account activity – reflecting customer demand for an easy to use, affordable way to manage their money.

“At Shakepay, our foundational purpose is to give hard-working Canadians better, more affordable options because we believe fees for basic financial services shouldn’t exist – period,” said Jean Amiouny, CEO of Shakepay. “Competition drives innovation. For our customers and the growing number of Canadians struggling to make ends meet, there is a place for secure, technology-based everyday payments that offer an exceptional customer experience without high fees that chip away at their savings.”

Shakepay’s new everyday payments include:

- Direct deposit: Shakepay customers can now send part or their entire payroll to be deposited directly to their Shakepay account. At their request, customers can also set up automatic bitcoin purchases.

- Pay a bill: Shakepay customers can pay a bill as they would from their traditional financial institution.

- E-Transfer your friends: Shakepay customers can seamlessly send Interac e-Transfers to anyone in Canada directly from within the Shakepay app.

- Shakepaid: A novel feature in the everyday payments space that can lead to high returns for our customers. Building off the successful and novel Shakepay Card program, Shakepay customers can get “shakepaid” and receive a little something extra with every incoming deposit, courtesy of Shakepay (minimum deposit is $100, max return is $1000 paid in bitcoin).

The product suite also includes the Shakepay Visa* prepaid card; one of Canada’s first bitcoin cashback cards that allows customers to earn up to 2% bitcoin cashback on all their purchases. This, and other reward programs, like #shakepaid, are key features that make Shakepay a preferred partner for Canadians looking to get the most out of their financial services.

Canadians, particularly Millennials and Gen Z, want more from their digital experiences and don’t want to pay high account fees. In 2023, Shakepay polled approximately 1,400 of its customers and found that 35% of respondents have little to no trust in their banks and do not feel well served by them, and 42% trust that fintechs such as Shakepay can become their everyday payments provider.

Founded in 2015, Shakepay has worked hard to position its flagship product, its Crypto Trading Platform (CTP), among the easiest ways to buy and sell bitcoin in Canada all while upholding the industry's highest safety standards.

Today, Shakepay has over 1.3 million registered accounts and has taken a proactive approach to regulation, securing a licence as a Money Service Business with FINTRAC. Shakepay is also the first Quebec-based CTP to become registered with all provincial and territorial securities regulators as a Restricted Dealer.

“We began as a bitcoin exchange focused on bringing bitcoin to the hands of all Canadians. Today, we’re bitcoin’s promise of a fairer financial system to the world of traditional finance and integrating them into products Canadians can use for their everyday payment needs,” continued Amiouny.

About Shakepay

Shakepay is reimagining financial services to give every Canadian their fair shake.

Shakepay is trusted by more than one million Canadians from every background — college students to retirees — giving them more control over their money and helping them improve their financial future.

Backed by renowned venture capitalists with a funding of $44M and regulated across all Canadian provinces and territories, Shakepay is headquartered in Montreal.

To learn more about Shakepay, visit shakepay.com.

Shakepay Prepaid Visa* Card is issued by Peoples Trust Company pursuant to licence by Visa Int.

*Visa is a trademark of Visa International Service Association and used under licence by Peoples Trust Company.