Why the Bank of Canada changes interest rates (and what it means for crypto)

Understanding how interest rates tie into crypto is key to navigating the upcoming changes from the Bank of Canada.

When the Bank of Canada changes interest rates, it doesn’t just bump some numbers on a chart—it impacts the entire economy. Whether it’s your mortgage payments, the value of the loonie, or your crypto portfolio, Canadians feel the ripple effects of those adjustments.

In a world where economic policy can shift overnight, bitcoin is becoming more than speculative assets—it’s a resilient alternative in an unpredictable system. And understanding how interest rates tie into crypto is key to navigating what’s coming next.

Let’s break down why the Bank of Canada adjusts interest rates, how these decisions impact bitcoin, ethereum, the broader crypto market, and what that means for Shakepay users.

Disclaimer: This content is for informational purposes only and should not be considered financial or investment advice. Always do your own due diligence and consult a registered financial advisor before making investment decisions.

First things first: What are interest rates?

Interest rates represent the cost of borrowing money (or the income you earn for saving it).

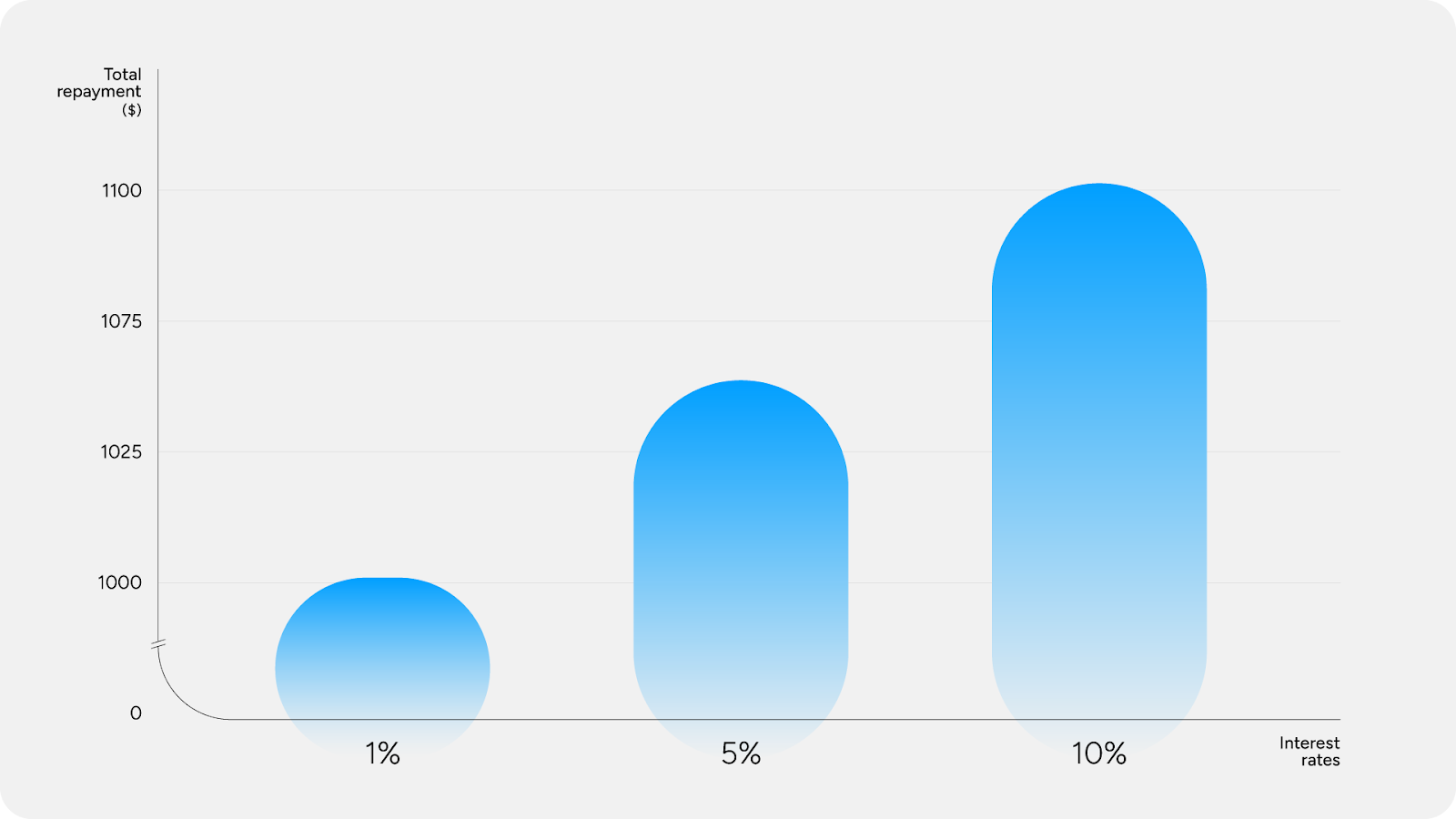

To put it simply, if you borrow money, interest is the price you pay to borrow it. When interest is charged on a loan, it means you’ll have to pay back that percentage of what you borrowed.

Let’s say you borrow $1,000 from the bank at a 5% interest rate. That means you’ll owe $50 extra over the year, so you’ll pay back $1,050 in total.

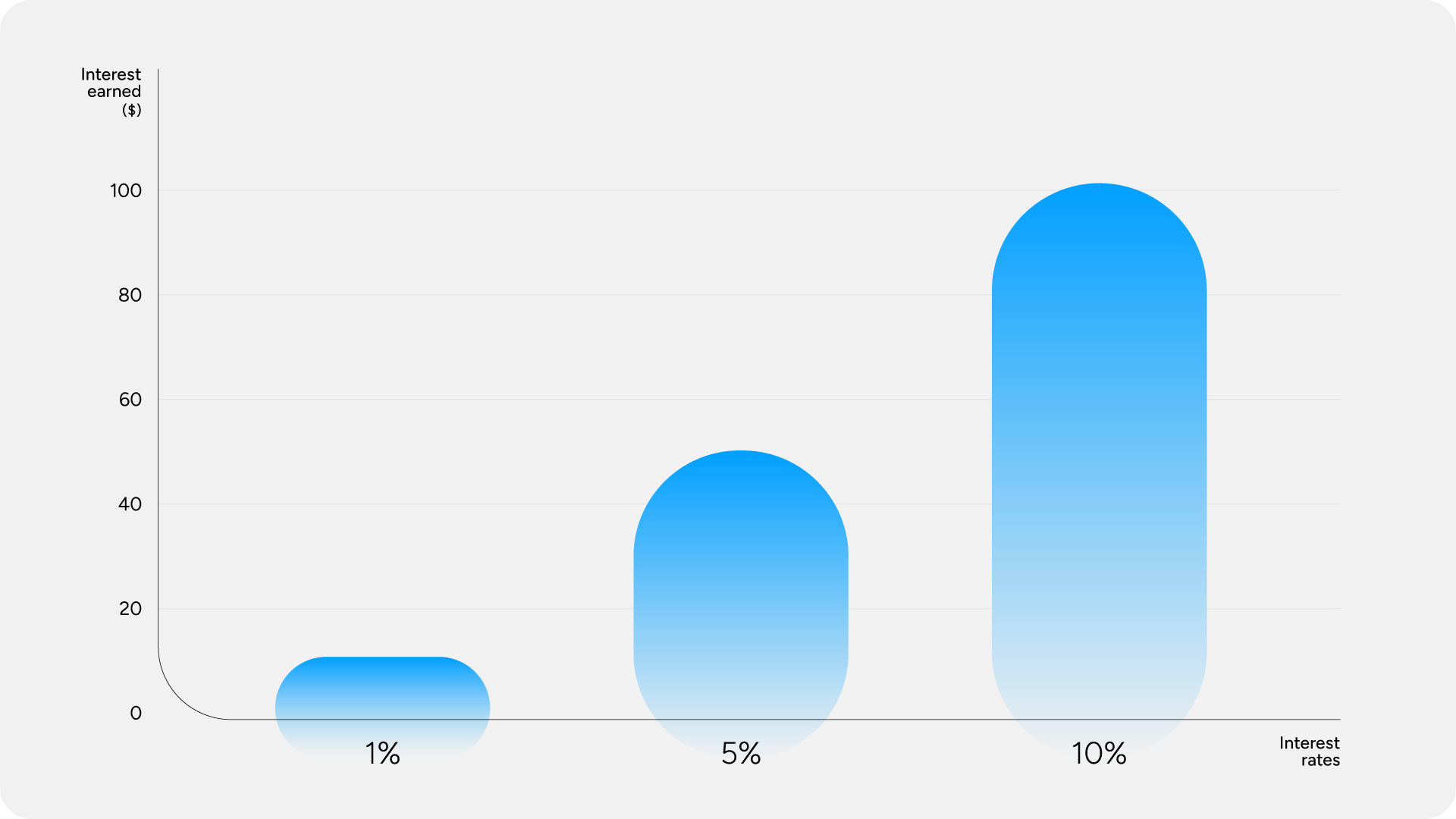

But interest rates also apply to saving your money. When interest is applied to your savings account or an investment, it means you’ll be paid out more than what you deposited

Using that same example as above: Let’s say you save $1,000 in a bank account. At 1% interest, you earn just $10 in a year. But if rates rise to 5%, you earn $50.

Takeaway:

- When interest rates go up: Borrowing gets more expensive, but saving gets more rewarding

- When interest rates go down: It’s cheaper to borrow, but your savings earn less.

Interest rates and the Bank of Canada

Interest rates fluctuate regularly and affect how expensive it is to borrow (or rewarding it is to save). They are set by the policy rate of central banks—in Canada, that’s the Bank of Canada. These policy rates are set based on the central bank’s understanding of the economy’s health and inflation.

The Bank of Canada’s overnight rate is the main interest rate that the big banks use when they lend money to each other. It adjusts these rates to help keep the economy growing at a steady pace and keep inflation in check.

This rate trickles down into:

- Consumer loans (mortgages, credit cards, car loans, home equity lines of credit)

- Interest-bearing savings accounts

- The price of the Canadian dollar

As the rate changes, so do the rates of interest charged on these types of loans/assets.

Why the Bank of Canada cuts rates

The Bank of Canada will lower the overnight rates to:

- Stimulate the economy when growth slows or recession risk rises

- Lower borrowing costs and encourage spending & investment

- Respond to low inflation or high unemployment

How it affects you:

- Cheaper mortgages and loans

- Weaker Canadian dollar

- Lower yields on traditional interest accounts

- Risk-on environment—assets like bitcoin, bthereum, stocks, and real estate often benefit

Bottom line: Lowering interest rates can help stimulate the economy and stimulate investment.

Why the Bank of Canada raises rates

The bank of Canada will raise interest rates to:

- Cool inflation when the economy is overheating

- Discourage excessive borrowing and stabilize prices

- Signal strong demand and economic momentum

How it affects you:

- Higher mortgage and credit card payments

- Stronger Canadian dollar

- Higher yields on savings and fixed income

- Risk-off environment—some investors may reduce exposure to assets like bitcoin and ethereum in favour of options like cash or bonds

Bottom line: While raising interest rates can slow down the economy, it can prevent the economy from overheating and from inflation getting too high.

The tariffs of it all

A reduction in interest rates would theoretically be positive for the Canadian markets, since its intent is to encourage spending and investing.

Enter: U.S. tariffs.

Tariffs are taxes on imported goods. The talk of increased tariffs, especially on big trading partners like Canada or Mexico, can drive up the cost of imported goods, which could fuel inflation in our supply chain.

At the same time, tariffs can also slow down global trades and investment, which puts a drag on economic growth.

For the Bank of Canada, that’s a tricky spot to be in: do you hold rates to fight inflation? Or cut them to support a slowing economy? That’s the least fun tug-of-war we’ve ever heard of.

But that policy tug-of-war is why bitcoin stands out.

It’s also why bitcoin and other systems of stored value are appealing alternatives. In these instances, a few things can happen:

- Global uncertainty increases (some investors may see crypto as a hedge)

- If central banks lower rates to offset slowdown, that’s usually bullish for crypto

- If inflation spikes, some investors turn to bitcoin as a potential store of value.

In this kind of uncertain environment, bitcoin is sometimes viewed as a way to diversify beyond traditional assets. Unlike fiat currency, it’s not tied to any government, central bank, or trade policy. For investors wary of getting caught in the crossfire of tariffs, rate hikes, and currency fluctuations, bitcoin offers a decentralized, inflation-resistant alternative.

Shakepay’s take

Whether the Bank of Canada hikes or cuts, it’s all about managing inflation and economic growth.

As a Shakepay customer, rate decisions can impact:

- Your bitcoin and ethereum strategy (some may choose to dollar-cost average in volatile markets)

- Your interest account positioning (do you lean into the Canadian dollar yield, or bitcoin and ethereum’s long-term potential?)

- Your perspective (specifically on inflation, fiat value, and asset diversification)

No matter which way the Bank of Canada moves, if you’re hedging against inflation or just crypto-curious, you can start earning Bitcoin automatically—just by spending like you normally would. No guesswork, no market timing required. Just spend, earn, and grow your stack with every purchase.