Dollar-cost averaging and bitcoin: How to build wealth over time

DCA is a simple, hands-off way to stack bitcoin consistently, no matter what the market is doing.

Timing the market is hard in the best of times. Now add in the unpredictable nature of crypto. Trying to time that market is like trying to ride a mechanical bull. In space. With your hands behind your back.

But investing in crypto or bitcoin doesn’t have to be so confusing.

One effective, and seriously low-stress, way to approach the world of investing is through Dollar-Cost Averaging. It’s a simple, hands-off approach to stack bitcoin consistently, no matter what the market is doing.

Let’s explore why this strategy works particularly well for bitcoin and how you can use Shakepay features to leverage a dollar-cost averaging strategy. Plus: Be sure to check out our guide, How to get started with Shakepay.

Remember: Investing in anything involves some inherent risk. While the benefits of DCA are supported by various studies, it's always important to do your own research. Consult with financial advisors to ensure it aligns with your individual investment goals and risk tolerance.

What is dollar-cost averaging?

The idea behind dollar-cost averaging (DCA) is simple: You purchase the same amount of an asset at regular periods over a certain amount of time. It can be monthly, bi-weekly—even daily! The point is that, no matter the price, you’re investing the same amount consistently.

This approach is effective because you don’t have to worry about timing the market and predict short term price movements (a notoriously difficult thing to do). Instead, with DCA:

- When prices are high, your fixed investment buys fewer units

- When prices are low, your fixed investment buys more units.

This steady approach allows you to lower your average cost per unit and reduces the impact of volatility.

How DCA works

DCA involves putting in a fixed amount of money at regular intervals (like weekly or monthly) instead of all at once. It’s an especially effective strategy when trying to decide whether to invest as you earn (i.e. $100 per paycheque) or waiting until you’ve saved a larger amount (i.e. saving $1,000)—or even waiting for a dip in price.

It’s also a great strategy for those who worry that "Bitcoin is already too high; I’ll wait for a dip before investing."

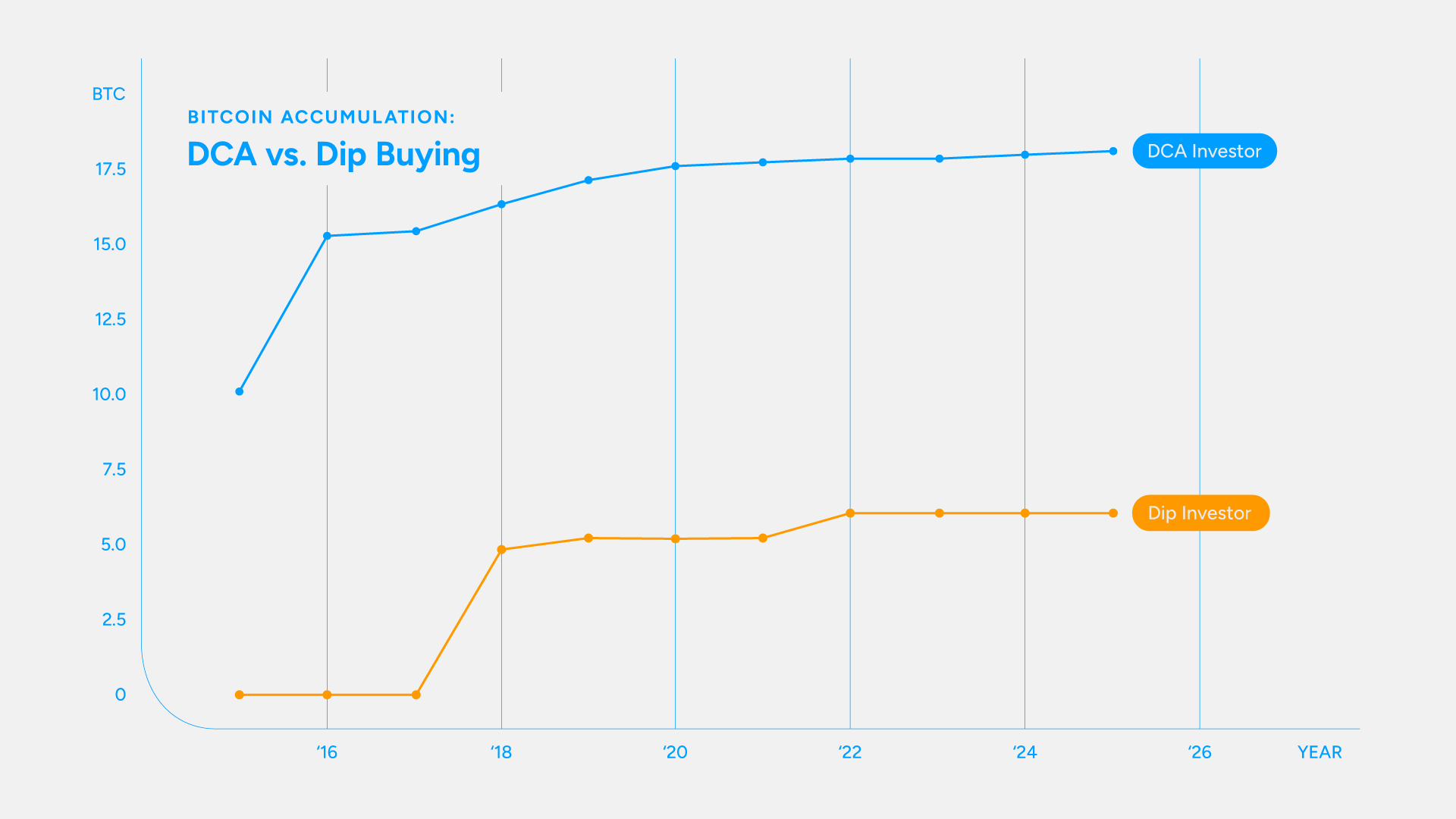

To illustrate this, let’s look at how bitcoin is accumulated by someone who invests consistently vs. someone who saves and buys at a dip:

- DCA investor: $100 every week, no matter the price of bitcoin

- Dip investor: Saves every week but only buys bitcoin during a drop of 25%

As you can see in the above chart, our DCA investor (in blue) is consistently stacking bitcoin, while our dip buyer (in orange) accumulates less bitcoin, since they’re only investing in select moments.

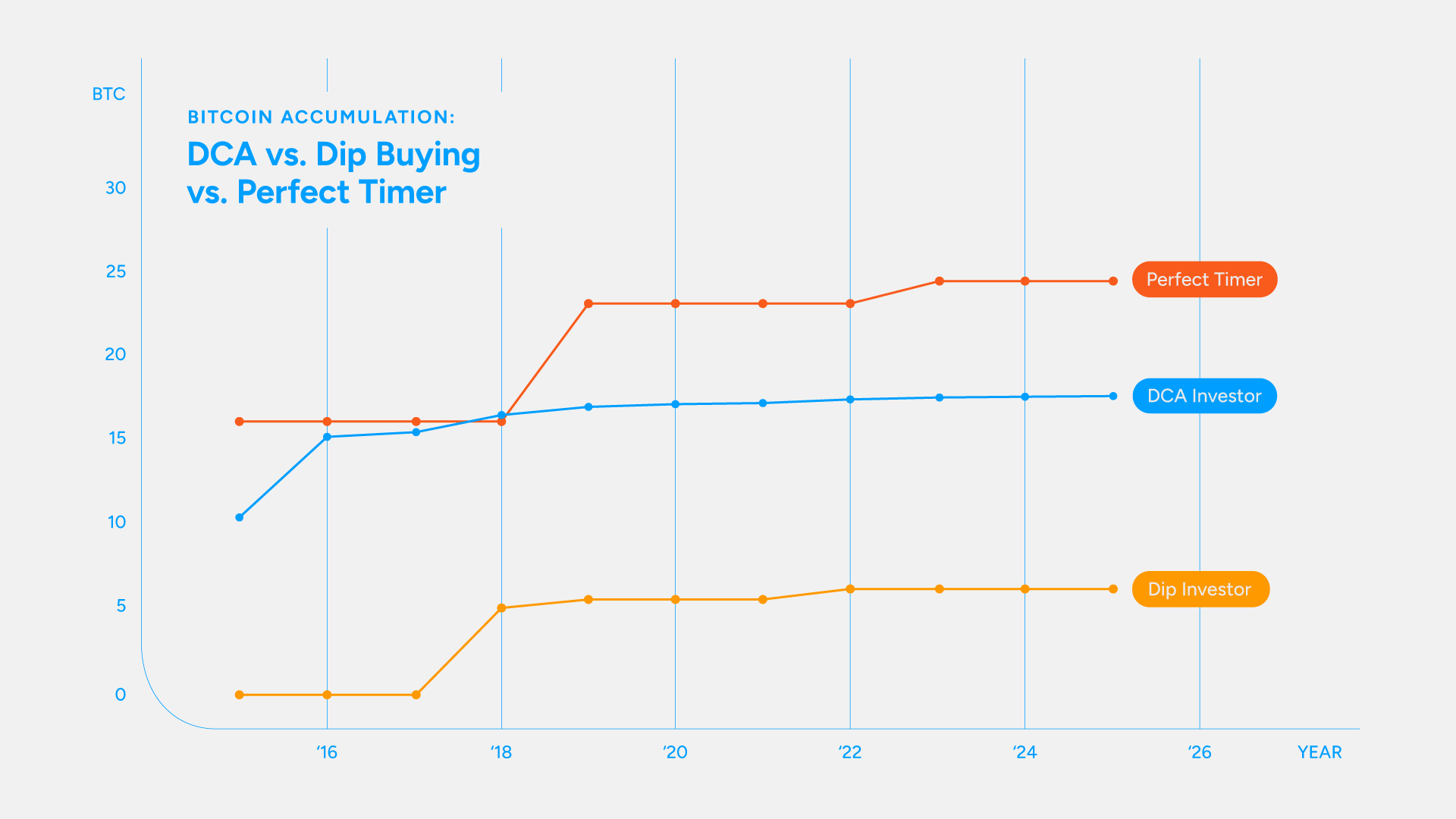

We also wanted to see what it would look like if someone who saves $100 every week and buys only at the bottom of a 4-year cycle.

Our perfect timer (in red) accumulated the most bitcoin between the three investors. But, as we all know, it’s incredibly difficult, if not impossible, to determine the bottom of a cycle—you’d need a crystal ball. In fact, one study found that, while flawless market timing does indeed earn you more, timing the market “perfectly” is nearly impossible.

Takeaways:

- DCA allows for systemic accumulation of bitcoin over time, which may help reduce the impact of volatility.

- Dip buyers accumulate less Bitcoin since they only invest in select moments, missing many buying opportunities.

- Perfect timers accumulate the most Bitcoin—but only if they know exactly when the cycle bottom is, which is almost impossible in reality.

A DCA strategy and bitcoin

Bitcoin and crypto markets are known for their sudden swings. Using a DCA approach in a market downturn means more shares are going to be purchased at lower prices over a longer period than with one lump sum (like our hypothetical scenario above).

At the end of the day, it all depends on your investing goals. But leveraging a DCA approach with bitcoin or crypto investment does come with several advantages, for both personal investors and businesses.

For personal investors, DCA has benefits such as:

- Low stress: You don't have to worry about predicting market swings because you're investing at regular intervals.

- No emotional decisions: Bitcoin’s price swings can provoke (very valid) emotional reactions. Using an automated investment process means no impulsive decisions.

- Accessibility: With recurring purchases automated, even smaller investors can gradually build a Bitcoin position over time.

For business accounts, a DCA approach provides:

- Strategic treasury management: By investing gradually without a large, one-time capital outlay, companies can integrate Bitcoin into their financial strategies without disrupting liquidity.

- Mitigating volatility: By spreading purchases over time, businesses reduce their exposure to price fluctuations, ensuring a smoother investment experience.

- Predictable budgeting: DCA allows businesses to allocate a fixed amount to Bitcoin on a regular basis, making it easier to budget for crypto investments while accumulating a strategic position.

Potential downsides of a DCA approach

It goes without saying that every investment strategy comes with its ups and downs. While DCA is effective, it has some downsides:

- May limit potential gains in a bullish market

- Fees could add up if the platform charges a flat fee for each transaction (something Shakepay doesn’t do).

How to set up DCA in Shakepay

DCA is one of the easiest ways to stack bitcoin without stressing about price swings. And with Shakepay’s Recurring buy feature, you place automatic buys at a pace you set, so it’s as easy as setting it and forgetting it to help you build bitcoin over time.

Here’s how to set up Recurring buys:

- Select the crypto you want to set up

- Select “Recurring Buys”

- Input the amount you want to buy each time

- Select the frequency you would like to buy

Note: Your recurring buy will only go through if there’s enough CAD in your Shakepay account.

And remember: DCA works best when you’re consistent, no matter what the market is doing. So buckle in for the long term and remember:

- Prices up: You’re stacking

- Prices down: You’re stacking more for less

- Over time, you lower your average cost and smooth out volatility.

Watching your BTC grow over time is part of the fun. Check your Shakepay app anytime to see how many sats you’ve stacked with our Recurring buy feature.

Set it and forget it with Shakepay

Join thousands of Canadians who are stacking bitcoin the smart way—automate your buys and take the stress out of investing.

Ready to stack smarter? Set up your recurring buys today and let bitcoin do its thing!